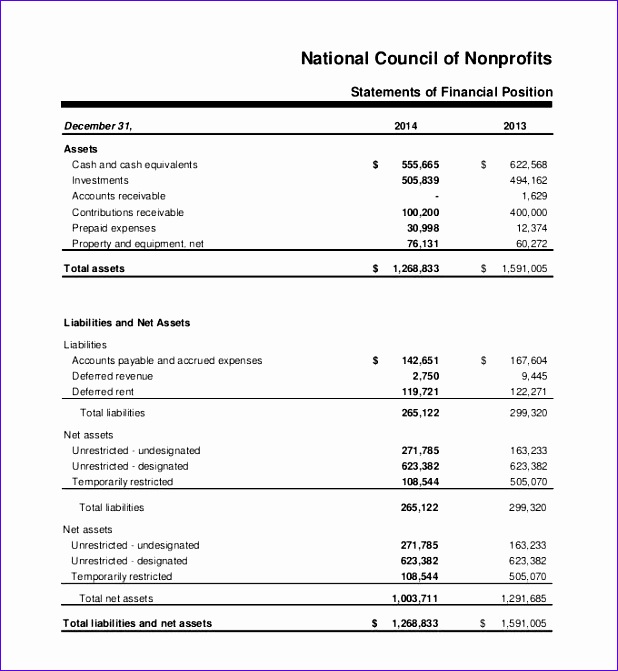

On the other hand, for-profit accounting involves tracking and reporting revenues from and expenses of producing goods or providing services for a fee. For-profit accounting also focuses on revenue sources and production costs, such as materials and labor. Some detail on the changes in the net assets section of the NFP’s statement of financial position is reported in the NFP’s Statement of Activities. Audits ensure financial accuracy, compliance, and transparency, often required by larger donors or government grantors. Following best practices in financial reporting not only ensures compliance but also strengthens the organization’s operations and impact.

Cash Flow Statement

While your assets are generally organized by liquidity, your liabilities are usually organized by due date. Short-term investments are usually labeled as current liabilities and should be owed within the year. Meanwhile, long-term liabilities represent the obligations that can be paid over multiple years. Once you’ve got a bookkeeping system in place, you need to start creating financial statements. Looking at these documents can tell you how much money you have, where your money is, and how it got there.

Key Components of Nonprofit Financial Statements

The nonprofit statement of financial position – also called a balance sheet – is essentially a report that shows a snapshot of your organization’s financial health. It measures your nonprofit’s assets, liabilities, and net assets in a single document. The balance sheet is also accompanied by other financial statements such as a cash flow statement to provide a more comprehensive view of the organization’s financial position. The Statement of Activities provides a detailed overview of an organization’s revenue and expenses. It shows how funds are generated and how they are used to support the organization’s mission and programs. This statement is crucial for understanding the financial health and sustainability of a nonprofit.

Understanding Nonprofit Financial Statements

This is because it’s possible for a nonprofit to have plenty of money, yet still struggle month to month. This is where you’ll list the things your nonprofit owes, such as your accounts payable, grants payable (if you give grants to other organizations), debt, and other expenses. If your nonprofit needs assistance putting together a financial statement or simply managing funds, indinero’s accounting services team is here to help.

As a nonprofit professional she has specialized in fundraising, marketing, event planning, volunteer management, and board development. Balance sheets are also an excellent way to track how your organization’s financial status has changed in past years. Nonprofits must abide by the laws concerning taxes, filing deadlines, and any other applicable regulations that pertain to their special tax status. Failure to comply with these requirements can result in loss of tax-exempt status, significant penalties, and fines. Taking care of overhead before seeking out donors for a nonprofit demonstrates financial responsibility and a commitment to efficiency—important decision-making factors for potential donors.

They include details about accounting policies, significant transactions, contingencies, and other relevant information that helps users understand the financial statements. The Changes in Net Assets section of the Statement of Activities provides valuable information about the financial health and sustainability of a nonprofit organization. It shows how the organization’s net assets have changed over a specific period of time.

You’ll discover what information each report includes, how to use it, and additional resources for exploring in more depth. Days cash on hand measures liquidity and estimates how many days of organizational expenses could be covered with current cash balances. AVAILABLE NOW – Great Beginnings for New Nonprofits, a free 8-part email course on fundraising, financial management and other “must know” topics. It is also worth noting that the valuation of assets is based on their historical cost or fair market value.

- By analyzing the balance sheet, decision makers can make informed choices that are beneficial for the organization.

- Just as you’d check your own backpack to see what you have and what you owe, a balance sheet shows what a nonprofit owns like money and property and what it owes like bills or loans.

- It shows how the organization’s net assets have changed over a specific period of time.

- Assets may include cash, investments, property, and equipment, while liabilities encompass debts, accounts payable, and other obligations.

- Each of these statements is essential to provide different insights into your organization’s financial situation.

- Read our article on tracking business expenses; much of our guidance is transferable to nonprofit operations.

Overall, nonprofit financial statements play a critical role in promoting transparency, accountability, compliance, and informed decision-making within nonprofit organizations. In this article, we have explored the sample financial statements for nonprofit organizations. We discussed the importance of financial transparency and accountability in the nonprofit sector. By providing a clear and comprehensive overview of the financial health of an organization, these statements help donors, stakeholders, and the general public make informed decisions. We examined the key components of nonprofit financial statements, including the statement of financial position, statement of activities, and statement of cash flows.

Finally, financing revenue comes from the earnings and interest earned on your financial activities and savings. We have created a sample balance sheet to help you create one for your organization. You can also use it as a template to add in extra information, change existing asset details, and calculate net assets. Review your annual tax returns for accuracy and to ensure claiming a domestic partner as a dependent that your organization is taking advantage of all available deductions and credits. Properly paying employees can help boost morale and motivation within the organization, leading to greater job satisfaction, improved productivity, and better quality services from the nonprofit. Donors will be more likely to give if they feel confident that you will use their money wisely.

GAAP provides consistency in financial reporting, making it easier for stakeholders to understand and compare financial information. Nonprofit organizations are required to file financial statements with the IRS to follow compliance laws. However, that is not the only reason why you would want to compile these reports. Preparing detailed financial statements can give you important insights into your organization. It also provides transparency to donors and, in turn, opens up opportunities to solicit significant gifts. You’ll also need financial statements if your organization ever decides to take out a loan from a bank or online lender.

The Statement of Financial Position provides an overview of the organization’s assets, liabilities, and net assets at a particular point in time. For nonprofits, net assets are categorized as either with donor restrictions or without donor restrictions—a critical distinction that affects how funds can be used. For nonprofits, income statements are often referred to as statements of activities. Like a for-profit company’s income statement, a statement of activities shows all of the financial activity that has taken place in your organization and the financial result of your work. Three of these reports are similar to for-profit business financial statements. One of the statements (the functional expenses statement) is entirely unique to nonprofits.